Wake County Appraisal District

Real Estate Wake County Government

Get information on what is taxed as real estate property and annual tax bills. Real estate property includes: - Land - Buildings - Structures - Improvements - Permanent fixtures - Mobile homes that are placed upon a permanent enclosed foundation on land owned by the owner of the mobile home.

https://www.wake.gov/departments-government/tax-administration/real-estate

Revaluation Wake County Government

... office reviews, and notice of assessment and appeal review. ... Copyright . All rights reserved. true. We use cookies on this site ...

https://www.wake.gov/departments-government/tax-administration/real-estate/revaluation2027 Revaluation Wake County Government

About the 2027 Revaluation Wake County is growing rapidly, and property values are increasing faster than ever. Between 2020 and 2024, property values rose by an unprecedented 51%. The 2024 revaluation reflected this change, with many property owners seeing significant increases in their assessed values.

https://www.wake.gov/departments-government/tax-administration/real-estate/revaluation/2027-revaluation

Wake County's New Property Revaluation Cycle

We are thrilled to announce that our founder, Gretchen Coley, has been invited to speak, not once, but twice, at the 2026 Compass NorCal New ...

https://thecoleygroup.com/blog/wake-countys-new-property-revaluation-cycle-what-raleigh-homeowners-need-to-know/Recommended Operating Budget and Capital ...

... 2026 Fiscal Year Recommended Budget. Wake County Facts 11. Wake County Facts. Wake County Facts. Wake County is growing at a rate of 66 people ...

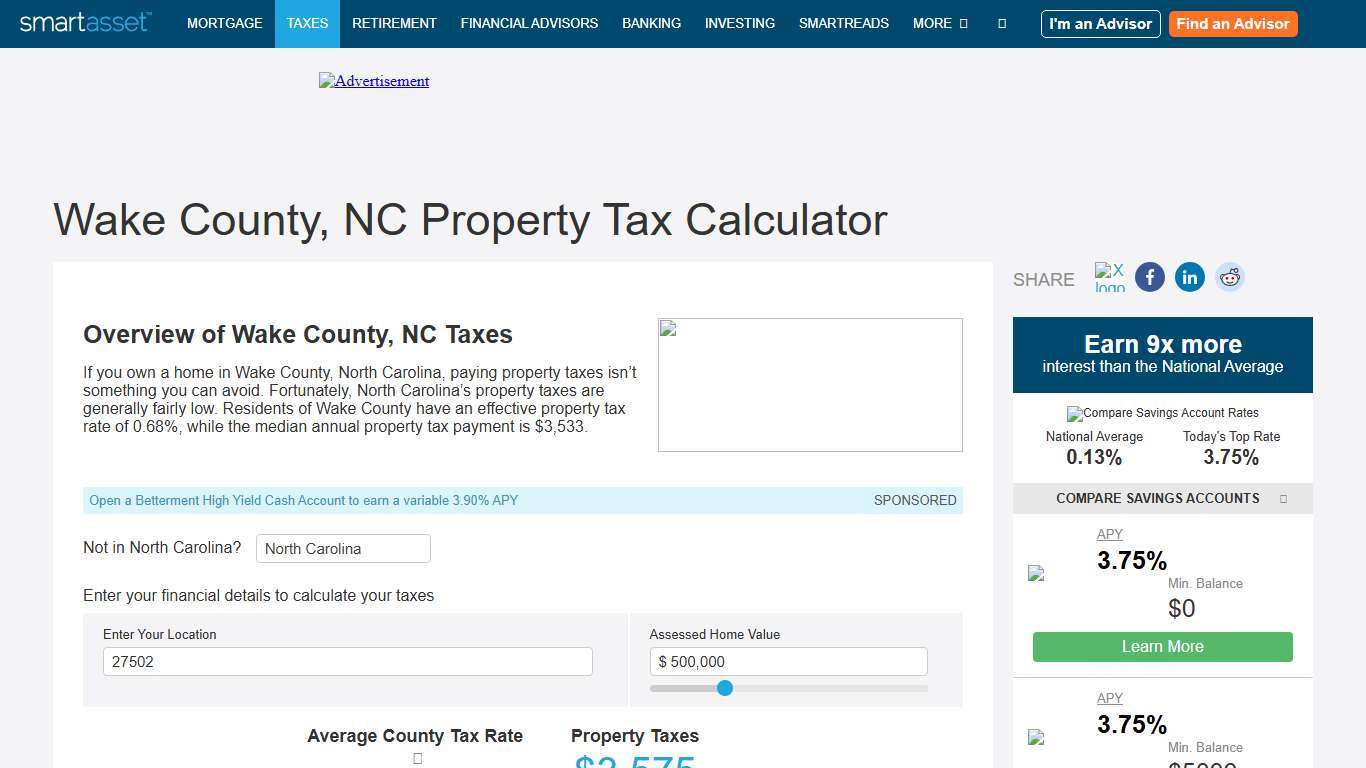

https://s3.us-west-1.amazonaws.com/wakegov.com.if-us-west-1/s3fs-public/documents/2025-05/Wake%20County%20FY26%20Recommended%20Budget_%20Web.pdfWake County, NC Property Tax Calculator - SmartAsset

Overview of Wake County, NC Taxes If you own a home in Wake County, North Carolina, paying property taxes isn’t something you can avoid. Fortunately, North Carolina’s property taxes are generally fairly low. Residents of Wake County have an effective property tax rate of 0.68%, while the median annual property tax payment is $3,533.

https://smartasset.com/taxes/wake-county-north-carolina-property-tax-calculator

Wake County's tax evaluations soared in value. Here's what happened - Axios Raleigh

We use cookies and similar tracking technologies to remember preferences, analyze traffic, and deliver ads. Using some kinds of trackers (like cross-site or behavioral advertising cookies) may be considered a “sale” or “sharing” of personal data under certain state laws. You can opt in or out of these trackers below.

https://www.axios.com/local/raleigh/2024/01/26/wake-county-soaring-tax-evaluations-takeaways

Wake Forest Real Community Information. Heard on the radio today Facebook

Honest question, not looking to get into a political argument… I thought this is a red state, completely controlled by the Republican party for decades. Therefore, why do NC taxes seem so much higher than other Southern red states? Also, why is this … With more and more housing being built , the tax base should be growing quickly .

https://www.facebook.com/groups/337911350786238/posts/1368389521071744/

Schedule of Values Wake County Government

Want to understand the methods and procedures used for Wake County's 2024 Real Estate Revaluation? The Schedule of Values, which by law must be approved by the Board of Commissioners, is a manual providing rates, value ranges, and guidelines for appraising property at market value in Wake County.

https://www.wake.gov/departments-government/tax-administration/real-estate/revaluation/schedule-values

Property Tax - Forms NCDOR

A new tax on alternative nicotine products will also be imposed. Tax related to the rate change of product in inventory as of July 1 will apply. For more information, review the tobacco products page. The Department has issued a new notice titled, Eligibility for Listing in the North Carolina Department of Revenue Vapor Products and Consumable Products Directory.

https://www.ncdor.gov/taxes-forms/property-tax/property-tax-forms

North Carolina County Uses AI for Property Revaluations

In what is billed as a pilot of the company’s AI technology, Cary-based SAS worked hand-in-hand with the Wake County tax administrator to determine how much every one of the county’s 400,000 properties should be valued. Its model constantly evaluates properties across the county, meaning it could have a theoretical value ready every single night.

https://www.govtech.com/computing/North-Carolina-County-Uses-AI-For-Property-Revaluations.html

Wake County Property Records Owners, Deeds, Permits

Instant Access to Wake County, NC Property Records - Owner(s) - Deed Records - Loans & Liens - Values - Taxes - Building Permits - Purchase History - Property Details - And More! Wake County, North Carolina, contains 12 incorporated municipalities or cities, along with two additional municipalities that extend partially into the county.

https://northcarolina.propertychecker.com/wake-county

Assessments Town of Wake Forest, NC

The Town of Wake Forest, like all North Carolina local governments, has the authority to levy special assessments for certain improvements (i.e. - street improvements, sidewalks and nuisance abatements). A payment plan is typically established with the special assessments. In the event a property with a special assessment is sold, these assessments are generally paid at closing.

https://www.wakeforestnc.gov/finance/assessments

🎉 Cue the confetti! 🎉 I’m humbled to... - Nancy Grace Homes Facebook

This award always hits different because YOU, the residents of Western Wake County (Cary, Apex, Holly Springs, Fuquay, and Morrisville) took the time to vote.

https://www.facebook.com/NancyGraceHomes/posts/-cue-the-confetti-im-humbled-to-start-2026-off-with-so-much-gratitude-in-my-hear/1390346213103988/